Private equity (PE) refers to both investors and managed funds that invest directly in private companies, allowing them to increase their working capital, make improvements in technology or acquire other firms without needing to rely on bank loans.

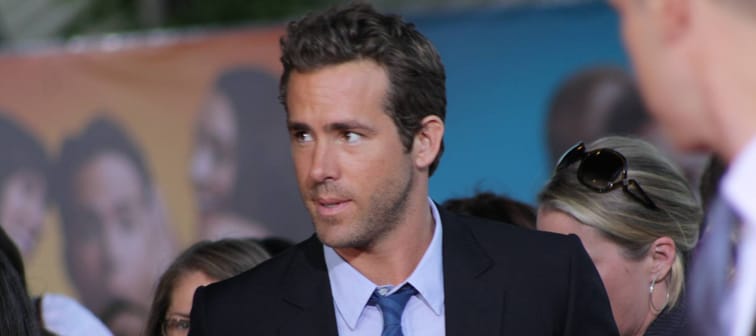

Some PE investors are known as “angel investors” thanks to their willingness to fund start-ups and help them meet their full potential. The appeal of being dubbed an angel is strong and has pulled in significant dollars from famous Canadians, including rapsmith Drake and actor Ryan Reynolds — who's gotten behind tech startups, including mobile services disruptor Mint, to help build their brands.

Other PE investors look to take control of distressed companies and, if they can’t turn them around, sell off the company’s assets at a profit.

One common form of PE investment is a “leveraged buyout,” whereby a company is bought out with the intention of first improving its business operations and then either reselling it for a profit or taking it public through an initial public offering.

As the name suggests, private equity investing isn’t for everybody. Because of the risks and high dollar amounts involved, only accredited investors are invited to the party.

In Canada, the term “accredited investor” is applicable to around 20 different personal financial scenarios. The most common includes holding assets of more than $5 million or earning a gross income of more than $200,000 annually for two years in a row — and expecting that income to grow during the current calendar year.

A private equity fund, which collects investors’ money and moves forward with the investments it considers potential wins, is made up of two groups: limited partners, who typically own 99 per cent of a fund’s shares and have limited liability, and general partners, who own the remaining shares, manage the investments and have full liability.

Because private equity investments usually involve long time horizons, liquidity can be an issue for some investors. Rehabbing a company so that it runs efficiently and turns a consistent profit can take time. And it can take even more time for the PE firm to find a buyer once things at the rehabbed company are running smoothly.

So investors must be prepared to have their capital locked up for some time.

While the returns generated by their investments make PE firms successful, they earn much of their income through the fees they charge investors. Those fees are no joke, either. They typically follow the hedge fund model of “two and 20,” meaning you’ll pay a management fee equivalent to about two per cent of the assets under management and a “performance fee” of around 20 per cent.

But, since the financial compensation for managers who handle private equity deals can border on the obscene, PE funds typically attract some of the sharpest minds in the investment industry. In PE, you generally get what you pay for.